The opportunities for financial services in the APAC region are vast. A report by McKinsey on the future of Asia for financial services describes the region as the ‘world’s consumption growth engine’, estimating that the region has around $10 trillion of consumption growth opportunity over the next decade.

McKinsey believes that those who miss Asia will ‘miss half of the global picture’ as the region continues to unlock more new opportunities for the finance industry.

Likewise, the latest EY Global FinTech Adoption Index, which surveyed 27,000 digitally active consumers in 27 markets, showed that Asia leads the world in FinTech adoption.

The result? A clear and present need for banks to go digital in order to offer better services to meet the exponential demand and compete in an ever more competitive marketplace.

But in order to seize the opportunity innovative and agile technologies will need to be available to banks, enabling better computational power, energy efficiency and, critically, an ability to harness data intelligently.

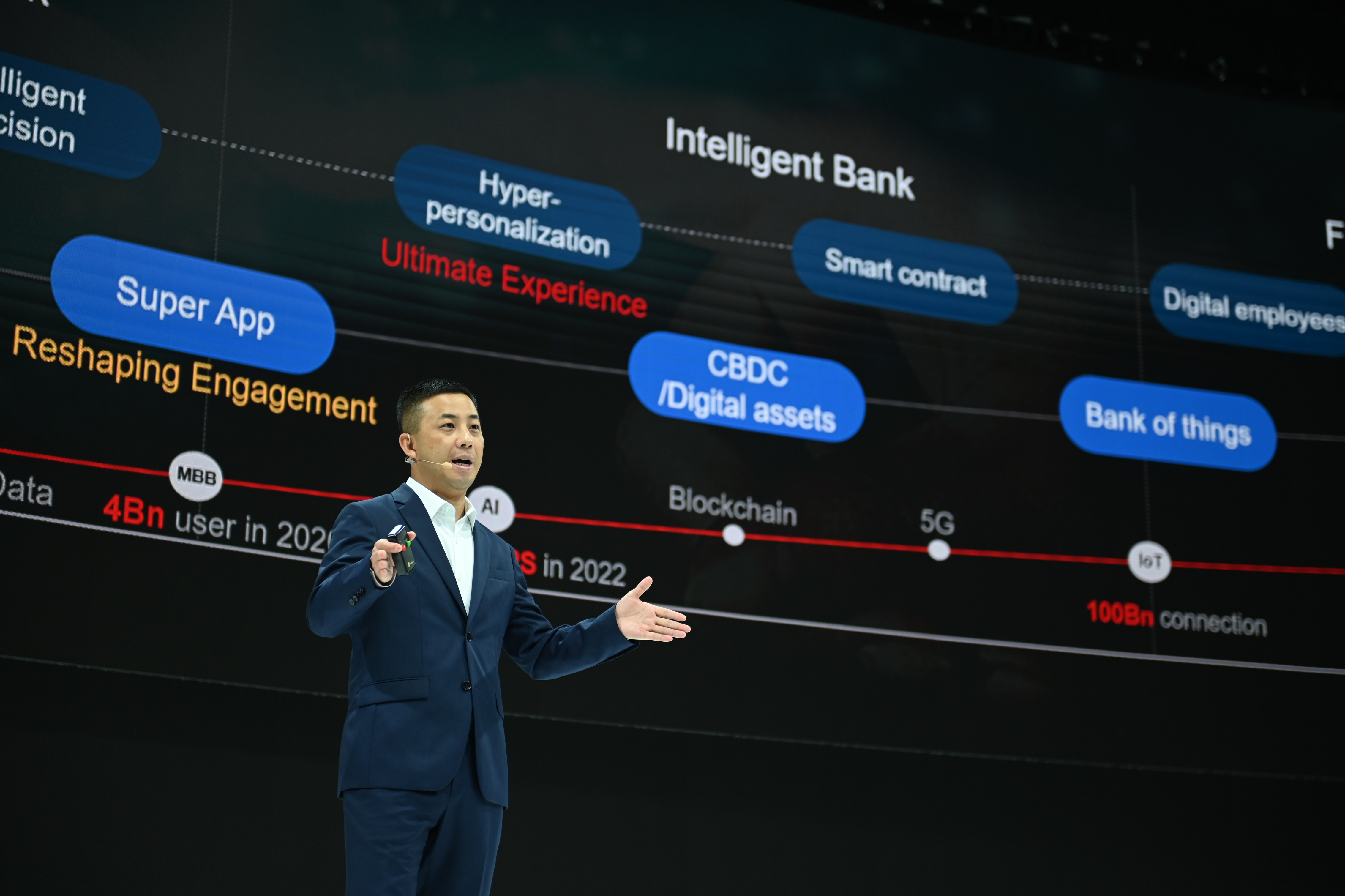

This central need was summed up in a speech at the Huawei 10th global finance summit in Singapore, when Jason Cao, Chief Executive Officer of Huawei Global Digital Finance, said: “Technology, especially the connection and intelligence, continues to drive the development of the financial industry.”

Go Greener

The environment is an ever-present issue, that all organisations need to consider as they move legacy systems to contemporary and future-proof technologies.

An example of this is a partnership that has put ‘green’ to the forefront of change. Huawei recently signed a Memorandum of Understanding (MoU) with the Singaporean bank Oversea-Chinese Banking Corporation (OCBC) for ‘Green Branch and Buildings’ which Huawei will help facilitate through the use of Smart Internet of Things (IoT) technology. This is where technology can be seen to have an immediate and beneficial effect on the environment.

Huawei will also work with OCBC on the sustainable development of the bank’s operations to lower carbon emissions by providing innovative solutions that integrate with smart IoT devices in the bank’s branches.

Go smarter

Being green is intrinsically linked to efficiency of operations, and here the digital transition plays the most significant part. Another example of an effective partnership is when Huawei has partnered with a number of banks to boost operational efficiencies by providing solutions around data and computing power.

By using Huawei’s OceanStor Dorado 8000 V6 solution, as well as FlashLink®, an intelligent algorithm uniquely designed for flash media, Kasikorn Business Technology Group (KBTG) partnered with Huawei for this solution, and as a result, KBTG can now deliver stable performance while simplifying operation and maintenance (O&M) and reducing IT costs.

UnionBank in the Philippines faced an uptick in its customer base by 160 per cent during the pandemic. By also deploying Huawei’s solution, the bank enjoys a reliable, secure, and future-proof network, having successfully made the transformation from a physical to digital operation.

In digitising their services offerings, banks across Asia have enlisted the help of Huawei on their journeys towards technological modernisation.

The Government Savings Bank (GSB) of Thailand paired up with Huawei when they sought to drive efficiencies by connecting a network infrastructure across large and small branches to ensure a smooth operation and a consistent level of service. GSB leveraged Huawei’s SD-WAN solution to create a strong cloud-based network to accommodate the new demands and future business expansion aims of the bank.

SD-WAN interconnected the bank’s headquarters, remote branches, and multiple clouds, resulting in unparalleled levels of service continuity, efficiency, and stability.

Go together

With more partners joining hands with Huawei, it is believed that more innovative solutions and products will be released in the near future, benefitting banks, especially in the APAC region, to grasp the opportunity to digitally transform their business, meet green initiatives, and provide better services to all customers.

Please click here to check out more on Huawei’s Intelligent Finance solutions.

Recent Stories