Global FinTech SumUp has raised €285 million in funding.

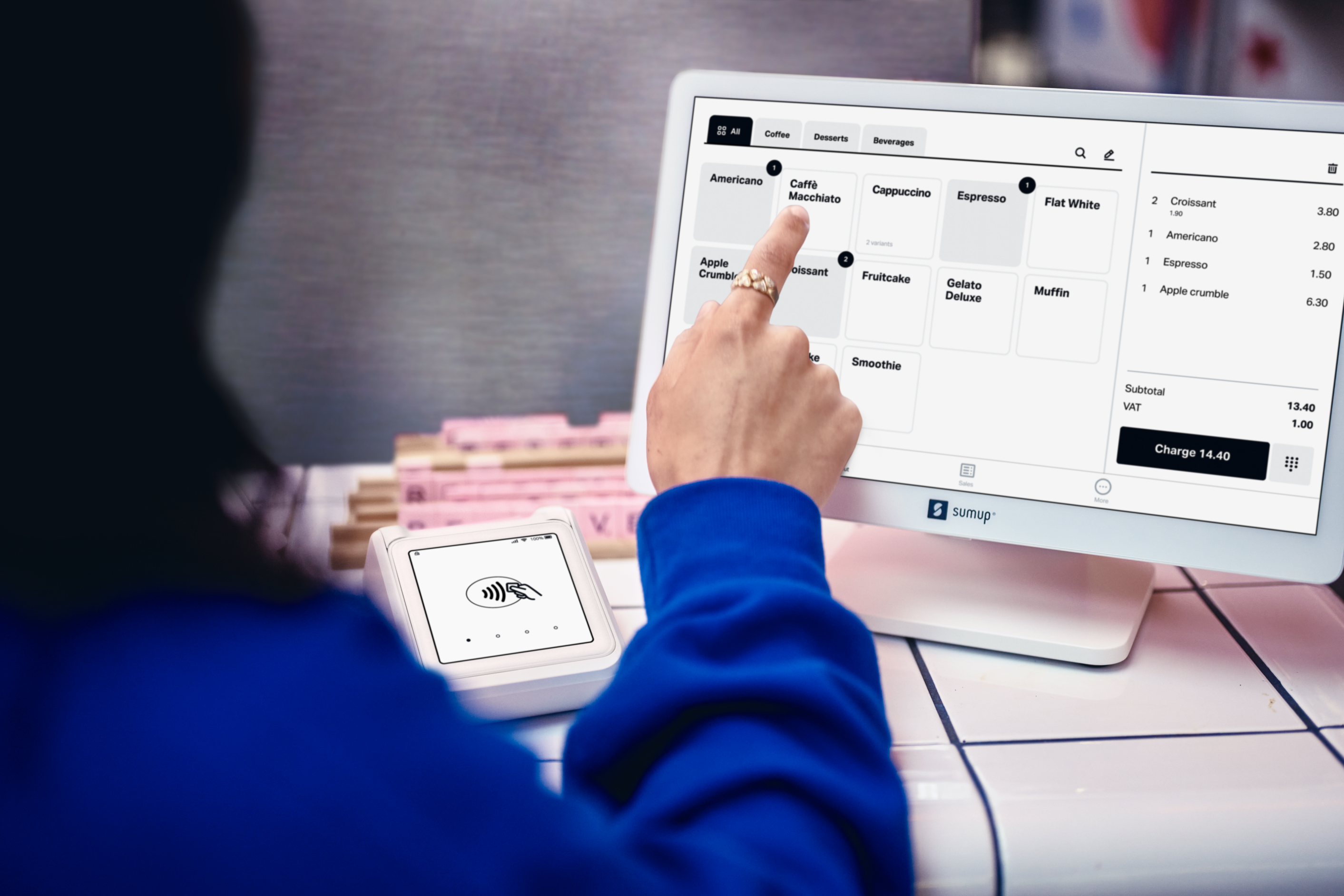

The company provides in-person and remote payment acceptance solutions which can be integrated with its card terminals and point-of-sale registers, while its app also enables merchants to set up a free business account and card, an online store, and roll out invoicing technology.

SumUp, which was launched in 2012, says that it will use the investment to expand its global presence.

The FinTech currently serves over four million merchants across 36 markets, after having most recently launched in Australia.

The company said the funding comes after a year of “accelerating momentum” for the business, which has been operating on a positive EBITDA basis since the fourth quarter of 2022. It has also experienced over 30 per cent top-line growth year over year.

"The consistent growth SumUp has shown over the past eleven years is a direct result of the success of the merchants we serve, and it would not be possible without the unwavering trust and support of the investor community. We are excited to have Sixth Street join that community," said Hermione McKee, chief financial officer, SumUp. "This funding gives us additional firepower to pursue growth opportunities and accelerate products that empower small businesses.”

The move comes after SumUp secured $100 million funding for a merchant cash advance product in the UK.

SumUp expanded its product and service suite for small merchants with the launch of a cash advance partnership with VPC in the UK, as well as Tap to Pay on iPhone in the UK, France and the Netherlands, and SumUp One, a membership plan that bundles its most popular features for one fixed, discounted price.

The company also announced a funding round of €590 million last year.

SumUp's most recent funding was led by Sixth Street Growth with further participation by Bain Capital Tech Opportunities, Fin Capital, and Liquidity Group.

Latest News

-

Gemini to cut quarter of workforce and exit UK, EU and Australia as crypto slump forces retrenchment

-

Bank ABC’s mobile-only ila bank migrates to core banking platform

-

Visa launches platform to accelerate small business growth in US

-

NatWest to expand Accelerator programme to 50,000 members in 2026

-

BBVA joins European stablecoin coalition

-

eToro partners with Amundi to launch equity portfolio with exposure to ‘megatrends’

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories