We are living through a fourth industrial revolution, led by a mix of emerging technologies. This shift means that financial services providers will have to rethink the way they operate to deliver new value for all stakeholders.

We are living through a fourth industrial revolution, led by a mix of emerging technologies. This shift means that financial services providers will have to rethink the way they operate to deliver new value for all stakeholders.

The Huawei Intelligent Finance Summit 2021, held 3 and 4 June in Shanghai (and broadcast on the Web), will explore these themes under the umbrella headline of Accelerate Financial Digitalization: New Value Together. The need now for knowledge sharing is particularly acute because digital transformation is not just a new norm but a constant.

Within this revolution, data is one of the major pillars and an ever-growing strategic resource – as well as an ever-growing issue. This data explosion demands revolutionary storage solutions that reach beyond traditional storage technologies to deliver significantly greater capacity and unified control but at lower, and greener, operating costs.

That is why so many banks are turning to all-flash storage. In particular, Huawei’s OceanStor Dorado has been an early leader in the sector, being adopted by more than 100 large financial institutions globally, including 8 of the world’s top 20 banks.

Technically, all flash-storage offers many opportunities, with ultra-fast response times – up to 21 million Input/Output Operations Per Second (IOPS) – flexibility, and unsurpassed reliability that allow banks to overcome the surge in transaction volume and performance delays. All of this can be achieved with reductions in the total cost of ownership and in a more environmentally friendly way; a far cry from the hard drive storage in use since the 1950s – with its mechanical spinning disks, motors, and magnetic read/write heads – each one a potential point of failure.

Practically, the adoption of such technologies allows for far reaching opportunities: Robotic Infrastructure, which includes unified management and control, end-to-end automatic deployment, intelligent O&M and fast service provisioning, energy-saving, high reliability, and intelligent financial digital infrastructure and deeper Data Intelligence as well as Agile Innovation. In turn, financial organisations can leverage these attributes to gain market share in growing areas such as Financial Inclusion and embedded digital financial services (Industrial Finance). These will also be explored further in the June Summit.

A matter of latency

Like many, EuroPoint's existing legacy storage was simply not up to the task and could not support new applications that would enhance customer experience and analytics. For EuroPoint, superior levels of low data latency as well as the ability to scale data securely were the key factors in the decision to upgrade.

To do this, the company wanted to find a partner with the ability to carefully plan the migration process, minimise unforeseen costs and unplanned downtime, and ensure that end-users would not be inconvenienced.

And while there were a few contenders available on the market, only Huawei's solution capabilities met the stringent technology requirements.With an innovative hardware platform, FlashLink, intelligent algorithms and end-to-end (E2E) Non-Volatile Memory express (NVMe) architecture, Huawei OceanStor Dorado offered latency as low as 0.05ms and could handle concurrent transactions of tens of millions of users.

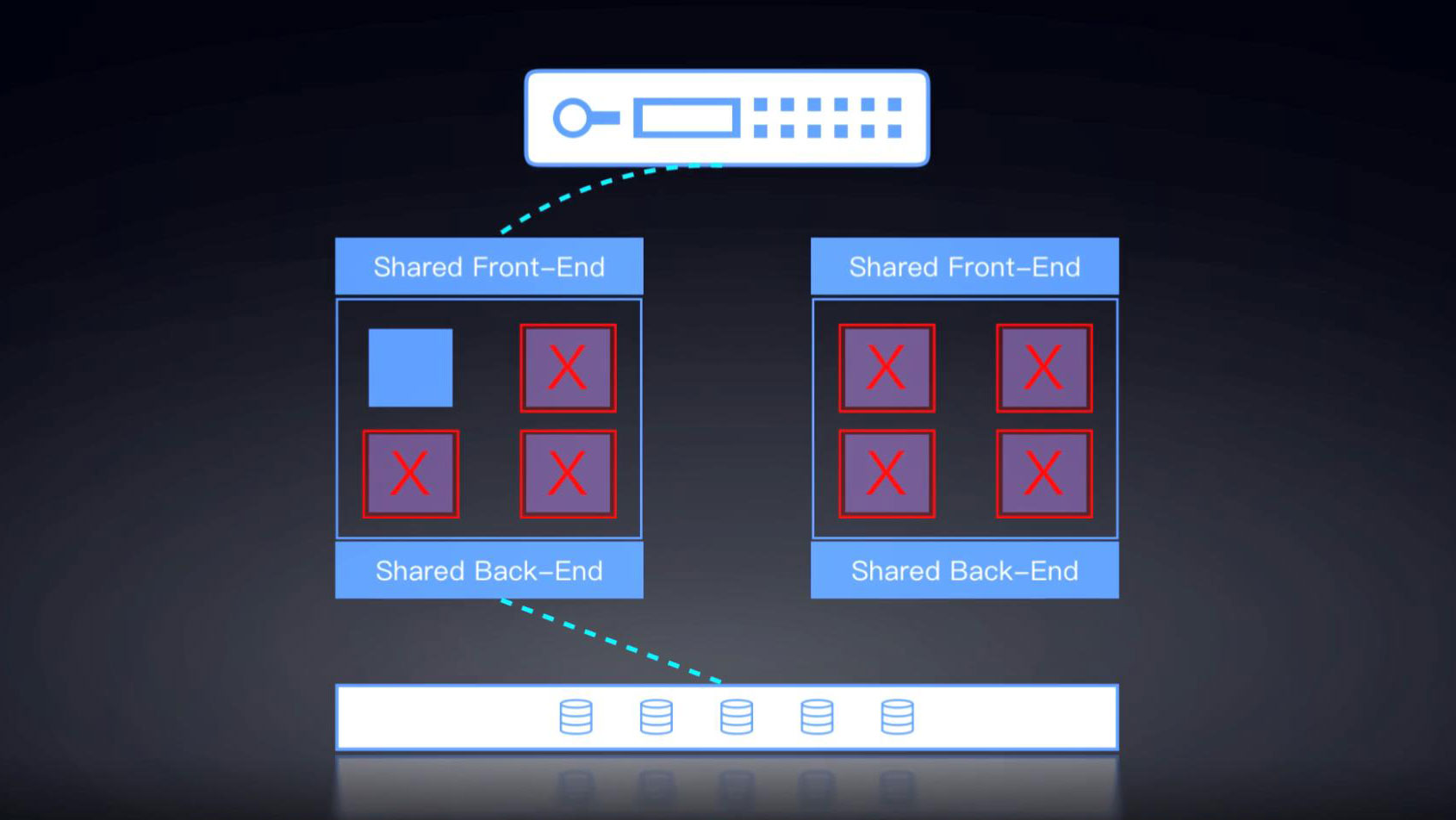

OceanStor Dorado all-flash storage was additionally chosen for its ability to effectively prevent any service interruptions, offering fault detection systems that allow services to always remain unaffected, with no waiting time during system upgrades.

EuroPoint has now also implemented a FusionServer Pro Rack Server to deliver superior performance and excellent scalability while improving data centre space utilisation. For the project, system implementation and data migration both went smoothly without any interruptions to customer services.

"Huawei's partner's storage and server virtualisation product knowledge, as well as its experience with data migration gave us a lot of confidence and was a big relief,” said Europoint director Niko Cuca.

While the highest level of reliability and availability of customer data supports the rapid growth of digital services, Huawei's solution has increased system performance and reduced application latency. EuroPoint's IT upgrade has also directly increased the satisfaction of end-users, ultimately helping it attract more customers.

Growing without the pains

In 2020, projected data growth was threatening the legacy storage resources of Swiss health insurance provider Sympany. While digitalisation across industries is leading to explosive data growth, in many instances, such data simply has to be stored locally so that it can be easily retrieved, but even with projections for future capacity requirements factored into the upgrade process, Sympany’s data growth was so high a new solution was required.

Fortunately, around this time the innovative OceanStor Dorado all-flash storage products appeared, allowing easy to integrate flash storage solutions.Paired with performance levels unrivalled in the industry and Huawei guaranteeing a compression rate of at least 2.6 to 1 with high reliability, tolerating the failure of up to seven out of eight controllers, Sympany had the confidence to make the leap to solid state.

“At these compression rates, we’re gaining even more storage space than expected, and such compression rates are also available when storing real-time services. The system is powerful, and we have a comfort zone, given the additional capacity. And that’s why this project can be described as a genuine, real-world success,” said Aleksander Baumann head of information technology operations at Sympany.

Learning from success

The two case studies present two different reasons why the move to all-flash storage with Huawei can help solve problems that older infrastructure cannot, allowing the vision of these two financial services companies to flourish.

However, there are also many other benefits that come with such an implementation that the companies discovered. As COP26 (UN Climate Change Conference of the Parties) nears, it is worth considering the impact of large data centres on energy use (they have the fastest-growing carbon footprint within the IT sector), and the massive potential carbon saving from a far more efficient storage solution.

Whether it be improved customer services, reduced costs or flexibility, the adoption of OceanStor Dorado all-flash storage provides the foundation for new innovative, digital solutions to be built, allowing the organisation to be more agile, adaptive and innovative while ensuring 24×7 business continuity. As digitalisation becomes an essential part of the programme, it is reassuring to know that a solution is out there that really can be a game-changer.

All these opportunities and solutions will be discussed at the forthcoming Huawei Intelligent Finance Summit 2021, Accelerate Financial Digitalization: New Value Together. To register to be there in person or see the webcast please follow the link, and discover more on the strategies, solutions, new ecosystems and new value that can be created as financial services move to fully digital futures.

Recent Stories