Enterprise architecture, application modernisation, inclusive data and AI, and in-depth integration of services and technologies, are all factors which can help any organisation to innovate. Jason Cao, Chief Executive Officer of Huawei Global Digital Finance, reveals how the business is supporting financial services organisations through their digital transformation journeys. Ross Law reports from MWC 2023.

The consumer financial landscape is in a state of flux. The playing field is materially changing as physical bank branches are used less and as the global economy continues to shift to a cashless model. Meanwhile, digital transformation is giving rise to new use cases and interactive experiences due to the increasing sophistication of artificial intelligence (AI) and cloud native applications.

This is how Jason Cao, Chief Executive Officer of Huawei Global Digital Finance framed the current state of play at MWC 2023 in Barcelona, where he also shared how the company is helping businesses in the financial services industry to get ahead of the curve on digital transformation.

Cao said that “innovation is in Huawei’s genes”, explaining that the company invested $22.4 billion (£18.6 billion) in R&D in 2021 and that the Chinese tech giant has continued to develop customised, scenario solutions to support continuous financial innovation.

“The finance industry has been accelerating its transformation from transaction to interaction,” Cao said. “Applications now embrace modernisation and cloud native, and green, intelligent, and simplified infrastructure has been built which continues to optimise the connection and touch points with customers.”

“With leading enterprise architecture, application modernisation, inclusive data and AI, and in-depth integration of services and technologies, anyone can produce incredible innovation.” said Jason Cao, CEO of Huawei Global Digital Finance during MWC 2023.

“With leading enterprise architecture, application modernisation, inclusive data and AI, and in-depth integration of services and technologies, anyone can produce incredible innovation.” said Jason Cao, CEO of Huawei Global Digital Finance during MWC 2023.

Cao added that recent years have seen the acceleration of data and AI being integrated into numerous areas of the finance industry. Data can now be analysed in real time with ease. Supported by AI, the true power of data has been ‘unleashed’, and is beginning to reshape the finance industry, he commented.

To support the rapid pace of change enabled by the development of real time data and AI, Huawei has been collaborating with its customers to build Super App platforms, launch digital credit within three months, enrich Super App products, and form new customer acquisition, services and interaction modes – all of which have, the company said, resulted in a 75 per cent reduction of customer acquisition costs.

Cao explained how the company’s infrastructure provision, cloud, GaussDB and data migration services, have been used by the Postal Savings Bank of China (PSBC), a bank with 650 million retail customers, to streamline its operations and become more flexible and agile.

Cao said: “We helped the PSBC reconstruct its core systems of 650 million retail users to a cloud native architecture with around 5,000 building-block components that maximise flexibility and agility.”

To deal with infrastructure performance, reliability, greenness, and O&M difficulties that come with a hybrid multi-cloud architecture, Cao said that Huawei would leverage the innovative advantages of cloud, storage, computing, network, and optical product portfolios.

“These actions will help to accelerate and support infrastructural evolution to our multi-domain collaboration, experience, green, and autonomous (MEGA) ethos,” he said.

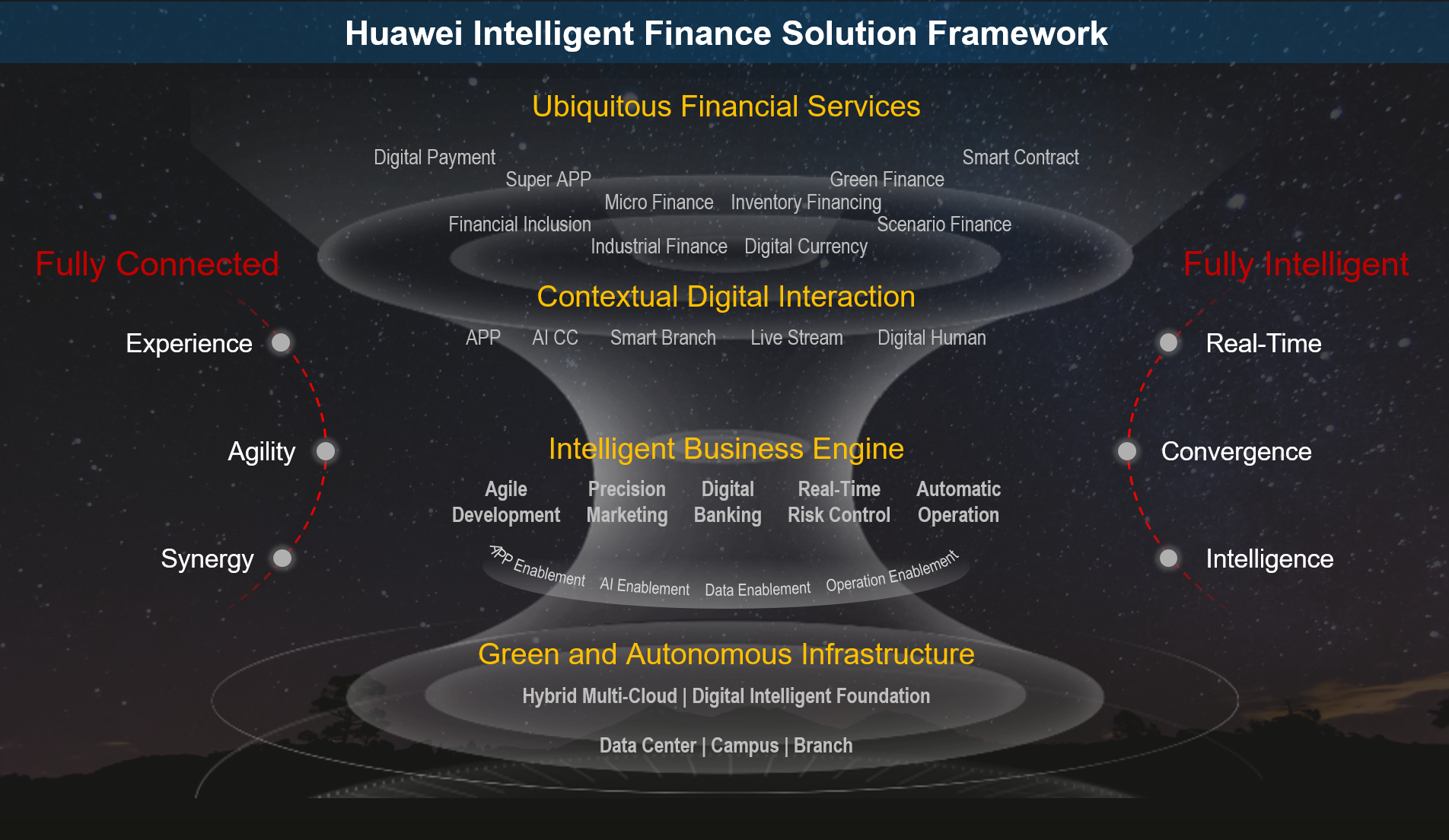

Huawei Intelligent Finance Solution Framework provides green and autonomous infrastructure, intelligent business engine, and super App platform for digital interaction and scenario innovation.

Huawei Intelligent Finance Solution Framework provides green and autonomous infrastructure, intelligent business engine, and super App platform for digital interaction and scenario innovation.

Another topic of discussion for the MWC panel was how Huawei has been continuing to build and support AI-based financial products and innovative customer experiences.

“Huawei is committed to building leading data and intelligent convergence solutions to accelerate the reshaping of financial services in terms of platforms, efficiency, and scenarios using AI,” Cao said.

He continued: “The finance industry needs to embrace cloud-native data platforms to accelerate real-time analysis and to facilitate the use of AI to analyse data with ease.”

Noting that traditional data warehouses cannot support multi-dimensional real-time analysis with Super Apps, Cao provided a further example where Huawei built a cloud-native data warehouse and real-time ETL for retail bank China Merchants Bank (CMB). This allows them to easily use and analyse data and implement elastic expansion.

“The infrastructure we built provides four times higher performance than the original data warehouse and supports lossless data migration,” Cao said.

Huawei’s experience in this area has resulted in over half of China's top 20 banks enlisting the company to build their next-generation data platforms.

“The first data warehouse took three years to roll out, but it now only takes three months,” Cao said.

Speaking in more depth about Huawei’s AI technology, Cao shared several further case studies.

In its work with one of China’s largest banks, Huawei’s AI tech accounted for more than 1000 scenarios. By using CV and OCR big models, Huawei worked with a major commercial bank in Shanghai in bill review and risk control exception identification of movable assets financing with a 99.99 per cent accuracy.

Huawei started designing its generative AI capabilities in 2020. Cao explained that Huawei has continuously expanded the capabilities of natural language processing, graph, and knowledge computing big models throughout this time, with hundreds of billions of parameters.

“An AI brain needs to be built to integrate AI into user experience and products and transform scattered innovation into full-service and full-process innovation,” Cao commented.

Cao concluded the conversation by stressing that next-generation financial enterprise architecture capabilities need to be developed based on platforms and services.

Cao added that there is a need for financial services products that can create value for customers and be flexible enough to adapt to meet evolving needs.

“By integrating low-code/no-code, runtime framework, and data intelligence into a common platform, we accelerate the modernisation of applications and the move towards cloud-native, and allowed data and AI to be invoked and obtained at any time.

“In this way, the value of business personnel who contact customers every day is maximised as their ideas and experience can be quickly transformed into innovative financial services products.”

Delivering his closing remarks on how innovation and digital transformation can continue to develop, Cao said: “With leading enterprise architecture, application modernisation, inclusive data and AI, and in-depth integration of services and technologies, anyone can produce incredible innovation.”

Learn more about Huawei’s innovation in intelligent finance here

Latest News

-

Mizuho to replace 5,000 administrative roles with AI

-

Allica achieves unicorn status through latest funding round

-

AI disruption risk varies between platform and service-based firms, says new report

-

ClearBank moves into the heart of London’s financial centre

-

Citi forms AI infrastructure banking team and invests in Sakana AI

-

HSBC chief Elhedery says overhaul nearly complete despite profit fall

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

.jpg)

.jpg)

Recent Stories