FStech news editor Alexandra Leonards caught up with Tony Craddock, founder of The Payments Association, to talk about everything from the impact of generative AI on the market to how payments firms need to do more for consumers during the cost-of-living crisis.

What are the biggest payments innovations you are seeing in the market at the moment?

There are innovations happening around the use of voice, video simulation, personalisation, gamification, and virtual reality. Some of the things that we’re seeing that are most exciting are digital currency, the new technology behind the platforms of Real Time Gross Settlement (RTGS), the shift in standards – which I think is an important innovation – and, of course, artificial intelligence. It’s kind of business as usual, with innovations being brought in by other sectors to deploy in payments. These four new innovations are going to have a material impact in the future of our industry.

What impact will generative AI have on the payments industry? Is it a fad or the future?

What is wonderful is that the technology follows a similar pattern to any breakthrough innovation. There are lots of early discussions and many people claiming to identify the optimum use cases, with very few people getting much traction.

What is extraordinary about generative AI is the pace – with ChatGPT reaching 100 million users just two months after its launch – and that’s because it has multiple applications. In terms of the pace, we see there is a yin and yang situation. On the upside, it’s going to improve decisioning and the identification of fraud, and it’s going to be improving the effectiveness of payments by identifying transactions that should be routed through one channel rather than another. It’s going to take what we currently do in terms of technology and turbocharge it.

It's also got a downside of course, because it may dehumanise the decision-making around who to give a product to or not and it could exacerbate the problems around financial exclusion. It could increase the gap between the leaders and the laggards, the early adopters and the late to the party people, and what we end up with if we’re not careful is a chasm between the haves and the have nots, between those who use AI and those who can’t, don’t or won’t.

Are you concerned about a loss of jobs when it comes to generative AI?

Well, ironically, I think there will be no more impact on jobs than any other new technology. Of course, some jobs will be lost, but they will be replaced by others.

Certainly, in the Western world, it will allow firms to give a personal service because instead of having to deploy the customer service person for $100 an hour, I can deploy AI for $2 – and that gives me twice as much personal attention to the consumer. I’m a big fan of generative AI with the caveat of the old ethical considerations. We’ve got to make sure this doesn’t feel so fast that we don’t design the adoption of AI in the workplace.

How has the cost-of-living crisis been impacting consumer payments habits?

We know that it’s likely to be availability of credit. And as interest rates are reducing people’s disposable income, it’s also increasing their fear of overspending. The need for them to budget very carefully then becomes exacerbated and therefore it’s more likely to bring people back to using cash. It’s easier to overspend digitally and everybody in the payments industry is slightly in denial about that.

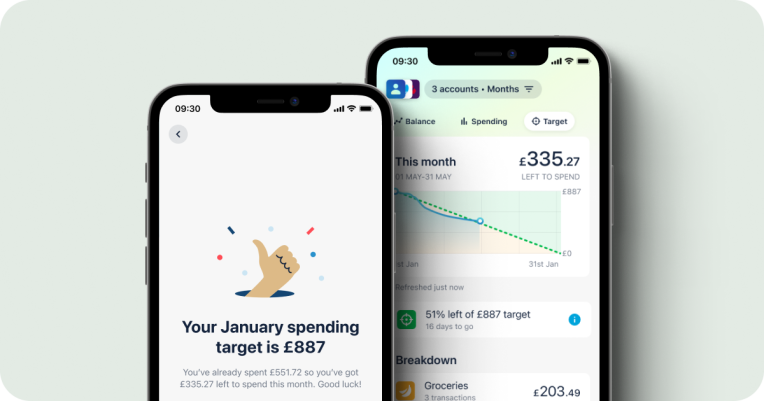

We have to take people with us and help them. We need to give them access to preferential credit, use all of the technology we have to invent the products that will be just right for them and that they find comfortable using, and help them manage their money. One of our members is Starling Bank and they do a great job of providing tools to help consumers manage their money – so there will be more people deploying these kinds of tools.

A recent study by digital payments company Carta Worldwide suggested that a third of consumers don’t think payments companies can help them tackle the cost-of-living crisis, what are your thoughts on this?

I think it’s true. You know, most of the payments industry deals with other companies – maybe 20 per cent of companies have an end user consumer – a third of which are businesses. The rest of us deal with other businesses, so it’s not in their faces.

It’s one of the reasons our community worked so hard at encouraging overcoming the financial exclusion problem. People do care for it when they’re made aware of it, but it’s much more like a step removed. So, I don’t think we’re doing enough.

I think we should do more to help people avoid criminals stealing their money, I think we should do more to encourage the adoption of new currencies like CBDCs and stablecoins.

We can encourage education and the adoption of better tools to help people manage their financial challenges. We can make it easier for them to do these things by making them free. And we can distribute them more effectively, making them available through to schoolchildren, for example, in the early stages of their financial lives.

What is The Payments Association’s perspective on a future digital identity? And where is the UK on this journey?

We’re strong advocates for having an individual passport. It’s referred to generically as a digital identity, but that has negative connotations around privacy. The NHS Passport, for example, was welcomed by everybody. So, we need to call it the right thing – digital passport or individual passport.

What I’ve noticed is that the government is encouraging public sector organisations to adopt an identity phase and there is some good progress being made. But it’s still not quite fast enough.

In this country, we don't like the idea of an identity. But we don't mind something that allows us to access a result more efficiently, for example if this is something that allows me to buy an insurance policy that doesn't require me to take a picture of my utility bill or photograph my passport.

Underneath that, you design a series of permission levels, so that not everybody knows much about you. They might just know that you’re an individual and that you reside in the UK, or that you’re over 18. So you can have a series of permissions and you give different permissions to different organisations based on where you want to give information. We need to design a scheme around this and make sure when I’m asked for my permission I give only as much as I want.

[A digital passport] could be launched in four or or five years – it’s not about whether this is a good idea, because it is a good idea. There’s no question about that. The problem is that depends upon getting enough votes, they have to be very careful about stirring up a hornet’s nest of political uprising and social discontent around something that people don't understand, because it’s very easy to misunderstand.

What new trends does The Payments Association expect to see in the payments industry over the next couple of years?

I think we’re going to see an increasing level of tension between regulators and everybody else. There’s already tension between the regulators and the adoption of consumer duty, we're already seeing tension between the FCA and the e-money firms around issuing of licences and supervision. There is tension between government ministers and the regulators. There will be conflict between those that want to promote the UK outside of the EU and the ones that want to make sure it aligns with the EU. I don’t think people are talking about this tension.

Open Banking is another – we’ve spent five years laying the foundation and now we have a clear road map issued by the Joint Regulatory Oversight Board Committee, which is supported by the Financial Conduct Authority (FCA) and the Payments Systems Regulator (PSR). It will show us what we need to do, how to get to sound commercial use cases and clear governance, having some ambition to move it beyond banking into financial services, and then beyond that into utilities, transport, hospitality, retail – it’s just a matter of time.

Latest News

-

Gemini to cut quarter of workforce and exit UK, EU and Australia as crypto slump forces retrenchment

-

Bank ABC’s mobile-only ila bank migrates to core banking platform

-

Visa launches platform to accelerate small business growth in US

-

NatWest to expand Accelerator programme to 50,000 members in 2026

-

BBVA joins European stablecoin coalition

-

eToro partners with Amundi to launch equity portfolio with exposure to ‘megatrends’

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories