Under 25s are more likely to have been victims of impersonation scams, according to new research by UK Finance.

The trade body for the UK's financial sector found that around half of 18-24 year olds had been contacted by an impersonation scammer compared to a third of those aged over 55. Of the 18-24 year olds who had been targeted, 52 per cent said they had shared personal information or made a payment as a result of the request.

Additionally, UK Finance said that young adults were the most confident of any age group in their ability to identify a scam, with 91 per cent of them claiming they would be able to spot a fake request for information online.

UK Finance warned that this confidence could put them at risk, as just 27 per cent said they will take steps to check if a potential scammer can be trusted. This compares to 60 per cent of over 55s saying they took steps to verify unexpected requests for information.

UK Finance said impersonation scams can be very sophisticated and criminals will gain a person’s trust to trick them into sharing information to allow them to steal money.

Over £1.2 billion was stolen through fraud in 2022 and there were 45,367 cases of impersonation scams in 2022 costing a total of £177.6 million, the research showed.

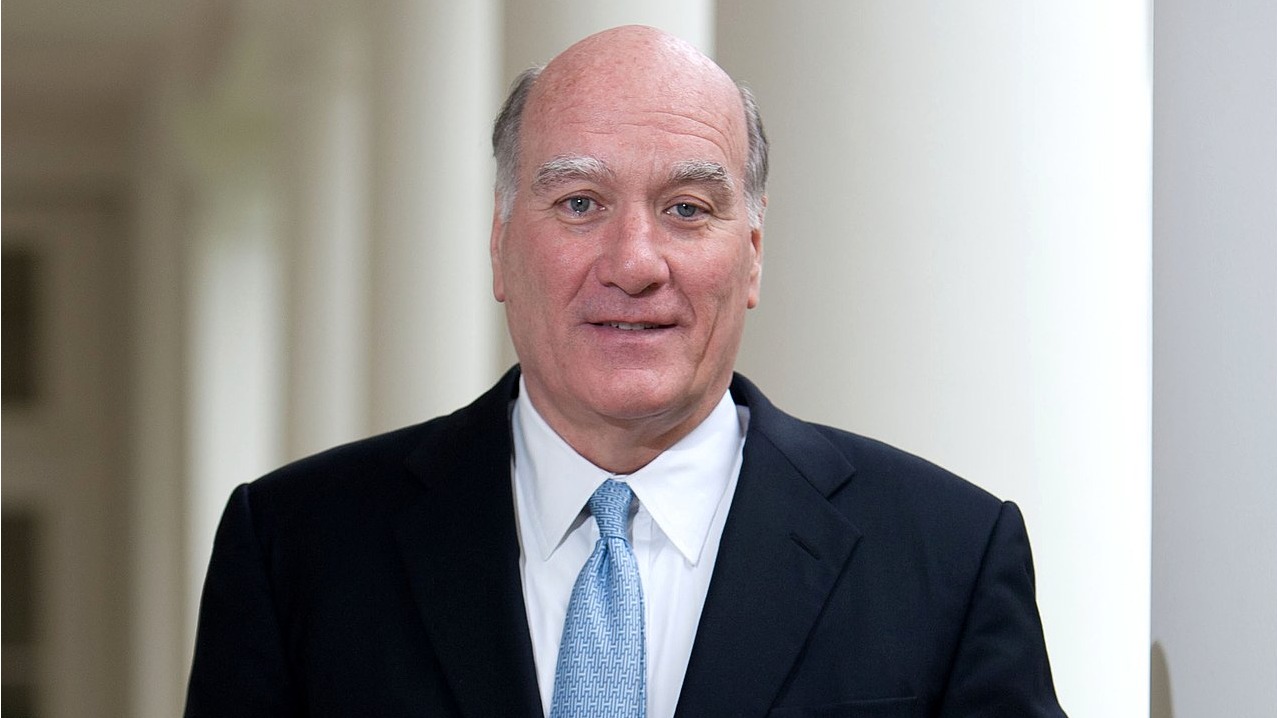

Commenting on the report's findings, Ben Donaldson, managing director of economic crime at UK Finance said: “Criminals who commit fraud are willing to target us all and they don’t need much information to create an identity online. They can then use that identity to steal our money and fund other crimes, which causes huge damage to both individuals and society.

“I'm very concerned about the number of young adults who are giving their personal information to criminals, who go on to cause so much harm.”

Latest News

-

Gemini to cut quarter of workforce and exit UK, EU and Australia as crypto slump forces retrenchment

-

Bank ABC’s mobile-only ila bank migrates to core banking platform

-

Visa launches platform to accelerate small business growth in US

-

NatWest to expand Accelerator programme to 50,000 members in 2026

-

BBVA joins European stablecoin coalition

-

eToro partners with Amundi to launch equity portfolio with exposure to ‘megatrends’

Creating value together: Strategic partnerships in the age of GCCs

As Global Capability Centres reshape the financial services landscape, one question stands out: how do leading banks balance in-house innovation with strategic partnerships to drive real transformation?

Data trust in the AI era: Building customer confidence through responsible banking

In the second episode of FStech’s three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech examines the critical relationship between data trust, transparency, and responsible AI implementation in financial services.

Banking's GenAI evolution: Beyond the hype, building the future

In the first episode of a three-part video podcast series sponsored by HCLTech, Sudip Lahiri, Executive Vice President & Head of Financial Services for Europe & UKI at HCLTech explores how financial institutions can navigate the transformative potential of Generative AI while building lasting foundations for innovation.

Beyond compliance: Building unshakeable operational resilience in financial services

In today's rapidly evolving financial landscape, operational resilience has become a critical focus for institutions worldwide. As regulatory requirements grow more complex and cyber threats, particularly ransomware, become increasingly sophisticated, financial services providers must adapt and strengthen their defences. The intersection of compliance, technology, and security presents both challenges and opportunities.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories